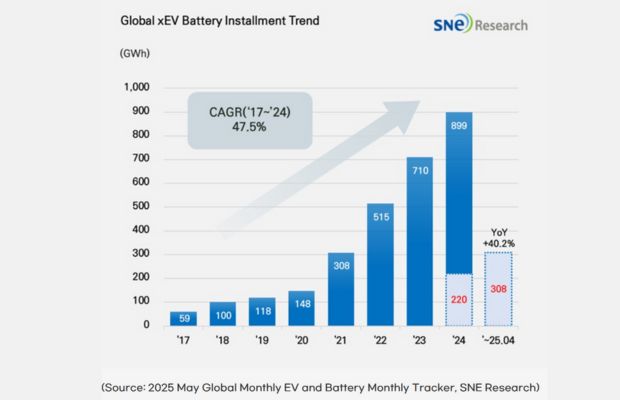

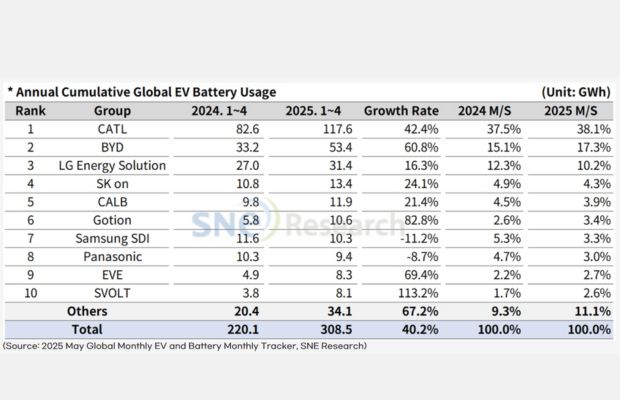

Global EV Battery Usage Posted 308.5GWh, a 40.2% YoY Growth From Jan to April 2025. During this period the energy held by batteries for electric vehicles (EV, PHEV, HEV) registered a worldwide increase of approximately 308.5GWh witnessing a 40.2% Year-Over-Year (YoY) growth, finds SNE Research.

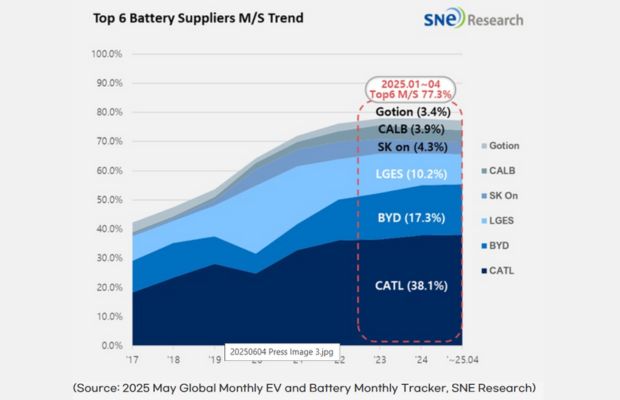

The report noted a decline in the combined market shares of LG Energy Solution, SK On, and Samsung SDI in global electric vehicle battery usage from the same period last year combined market shares of LG Energy Solution, SK On, and Samsung SDI in global electric vehicle battery usage from Jan to April 2025 posted 17.9%, a 4.6 decline from the same period last year.

Global Ranking

LG Energy Solution remained 3rd on the list with 16.3%(31.4GWh) YoY growth. SK On ranked 4th with a 24.1%(13.4GWh) growth. On the other hand, Samsung SDI exhibited an 11.2%(10.3GWh) degrowth. The downward trend in Samsung SDI’s battery usage was mainly caused by a decline in demand for batteries from major car OEMs in Europe and North America.

The report also looks at the usage of battery made by the K-trio in terms of the sales volume of models, Samsung SDI’s battery was mainly used in BMW, followed by Audi and Rivian. BMW has Samsung SDI batteries in its models such as i4, i5, i7, and iX, and among these, the sales of i4 and i5 were favorable.

On the other hand, even though Rivian posted a steady sale of R1S and R1T in the US, the release of standard-range trim with LFP battery, made by a battery maker other than Samsung SDI, harmed the installment volume of battery made by Samsung SDI. AUDI saw a decrease in sales of Q8 e-Tron, while sales of Q6 e-Tron, to which the PPE platform is installed, have increased, leading to a 6.2% decline in the usage of Samsung SDI’s battery in AUDI.

SK On’s battery was mainly used in EV models made by Hyundai Motor Group, followed by Mercedes-Benz and Volkswagen. Hyundai Motor Group saw a recovery in sales after the facelifted version of IONIQ 5 and EV 6 were released. Ford also saw a sale of F-150 Lightning to which a large-capacity battery is installed. Along with this, favorable sales of VW ID.4 and ID.7 also brought about a positive impact on the growth of battery usage made by SK On.

LG Energy Solution’s battery was mainly used by Tesla, followed by VW, Chevrolet, and Kia. In the case of Tesla, the sales decline of models equipped with LG Energy Solution’s batteries led to a 14.3% decrease in Tesla’s usage of LG Energy Solution’s batteries. Meanwhile, the total usage grew by 146.4% due to favorable sales of VW’s ID series and Kia’s EV3 and increased sales of Chevrolet Equinox, Blazer, and Silverado EVs, which are built on the Ultium platform. Panasonic, which supplies batteries to Tesla, ranked 8th on the list with a battery usage of 9.4GWh. Panasonic is currently working to restructure its supply chain in response to the recently strengthened U.S. tariffs on Chinese batteries and raw materials and is implementing a strategy to increase the proportion of local production within the North American region. In particular, Panasonic is focusing on reducing its dependence on Chinese materials and securing new materials while expanding local procurement to build a stable battery supply chain. These efforts are expected to lead to a recovery in battery usage and enhanced supply stability in the North American region in the future.

CATL remained top in the global battery usage ranking, growing by 42.4%(117.6GWh) compared to the same period of last year. Key OEMs such as ZEEKR, AITO, Li Auto, and Xiaomi adopted CATL’s batteries, and many global major OEMs, including Tesla, BMW, Mercedes-Benz, and Volkswagen, are also using CATL’s batteries.

BYD ranked 2nd on the list with a growth rate of 60.8%(53.4 GWh). BYD, which manufactures both batteries and electric vehicles (BEV+PHEV) in-house, is gaining significant popularity by introducing a variety of electric vehicles to the market, leveraging its strong price competitiveness. In 2025, BYD’s electric vehicle sales are expected to reach approx. 6 million units, and by staying in an upward trend, BYD is expected to continuously expand its global market share.

Global Impact Of Policy Shift

Meanwhile, the United States is positioning itself at the center of global supply chain restructuring not only through policy changes such as the IRA and AMPC incentives but also through recently strengthened regulations on Chinese batteries and materials.

These policy shifts present both opportunities and challenges for Korean battery companies aiming to enter and expand their presence in the North American market. In response, Korean firms are seeking to secure stable supply chains by establishing local joint ventures and expanding battery production lines within the US Over the mid to long term, it will be essential to enhance global competitiveness through diversification of material sourcing and technological innovation. At the same time, in order to respond to Europe’s tightening carbon neutrality policies and intensified price competition from China, companies must develop market-specific global strategies and pursue sustainable growth through localization and strengthened partnerships.