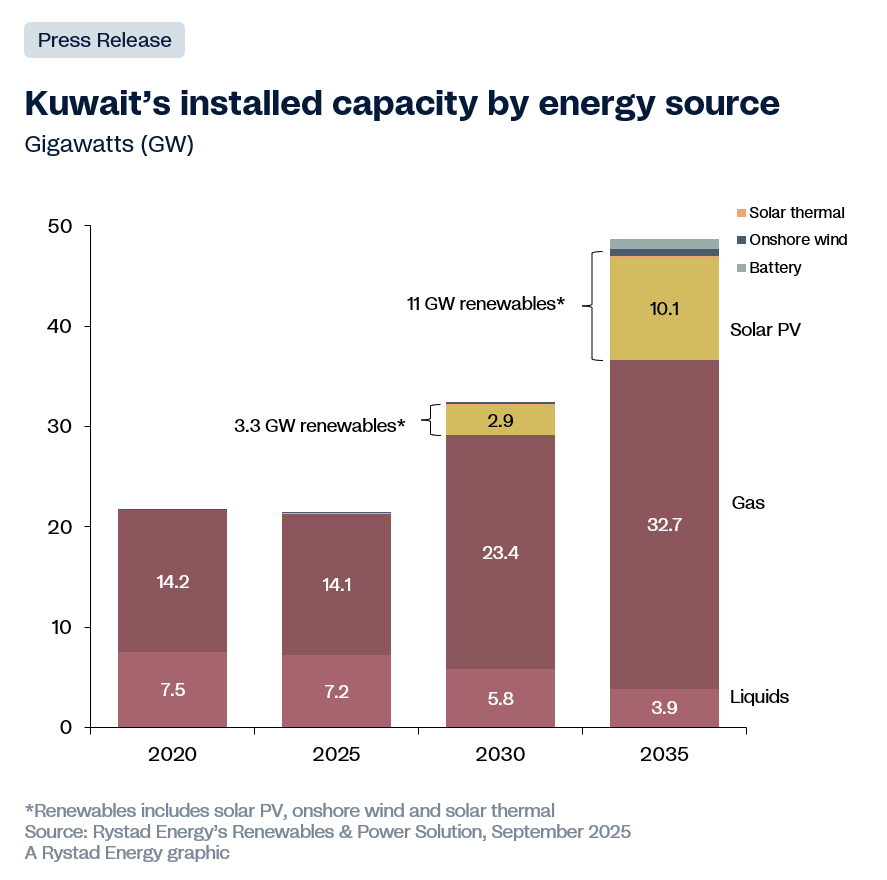

Kuwait is facing an acute power crisis fueled by extreme heat, ageing infrastructure, and unscheduled outages, prompting urgent moves to overhaul its power sector, according to fresh analysis from Rystad Energy. Despite ambitious targets to increase the share of renewable from below 1 per cent to 15 per cent by 2030, projections suggest that Kuwait may fall short, with renewable capacity expected to reach only 3.3 GW, roughly 7 percent of total generation, by the end of the decade.

Rystad Energy sees a 15 percent renewable share as more realistic by 2035 for Kuwait, when over 11 GW of renewables could supply nearly 20 percent of Kuwait’s electricity needs.

Peak Demand Strains Hit Hard

Kuwait currently operates 21 GW of installed generation capacity, but only about 17 GW is reliably available during peak summer months due to ageing plants and planned maintenance.

With temperatures soaring to 50°C in recent years and July demand peaking at 17.7 GW, the country began scheduled power cuts two months earlier than usual, compounded by unplanned outages that caused shortages of over 1.5 GW in May.

Slow Renewables Expansion

Kuwait’s grid reliability investments are ramping up in response to blackouts that have forced authorities to rely on imported electricity to patch deficits.

A Renewables & Power Research analyst at Rystad Energy, Nishant Kumar, emphasised that despite scepticism raised by blackouts and events like the 2025 Iberian outage, Kuwait’s abundant sunshine—over 3,300 hours per year – positions it favorably for solar PV investments, which can help meet peak afternoon demand. Yet, grid bottlenecks and slow rollout of flagship renewables projects mean that the country is still lagging its stated targets.

Gas: The Transitional Backbone

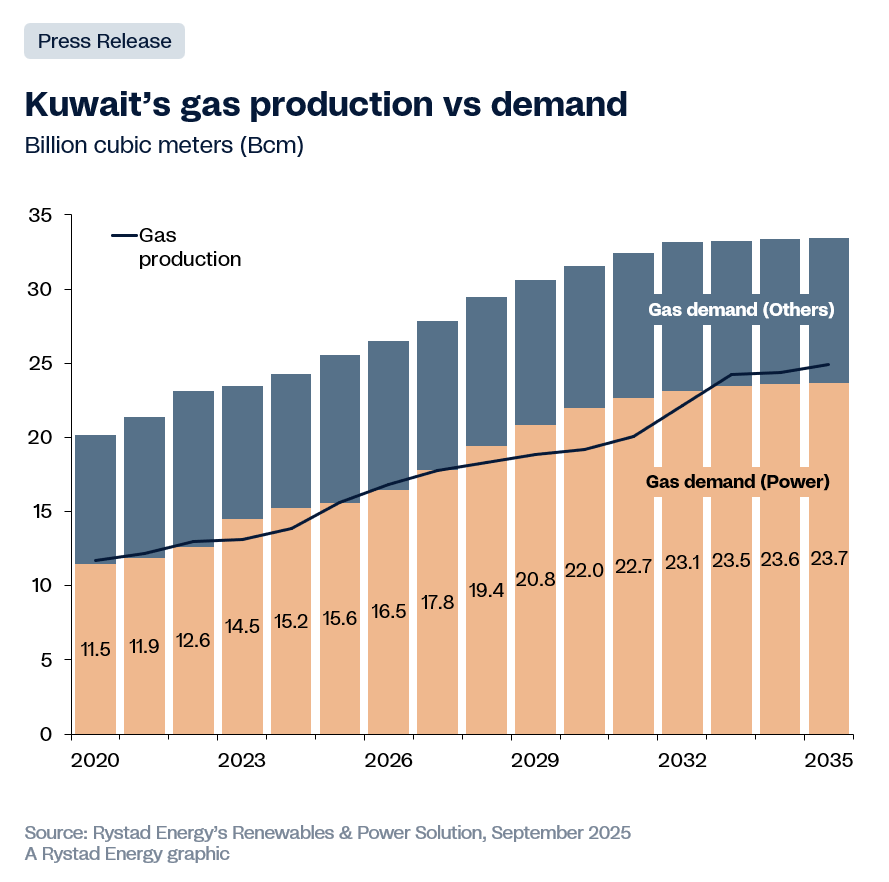

As Kuwait embraces renewable development, natural gas will act as a critical bridge in the coming decade, the analysis notes. Rystad Energy projects a 17 percent jump in gas-fired power generation to 77 TWh by 2030, with domestic gas production and LNG imports covering the surge in demand.

The nation is building five large-scale gas-fired power stations, set to add 18 GW of new capacity and push total gas power capacity beyond 32 GW by 2035, up from today’s 14 GW.

Kuwait has sealed a high-profile 15-year LNG supply deal with QatarEnergy, securing up to 3 million tonnes per annum starting in 2025 to backstop the fuel supply for summer air conditioning demand. Nearly 40 percent of Kuwait’s current gas needs are met with imported LNG, a share projected to remain significant as power sector demand grows.

The nation’s power sector currently uses oil for about 40 percent of its energy mix, but the government is accelerating the switch to gas to free more crude for export, a pivotal strategy to maximise export earnings and stabilise public revenue against surging electricity demand.

To mitigate risks from OPEC+ crude output cuts that hit associated gas supply, Kuwait is investing in non-associated gas developments, notably the Jurassic onshore project, which now covers nearly 25 percent of total domestic gas needs.

Outlook: Renewables’ Rise Hinges on 2035

As Kuwait grapples with immediate grid resilience needs, Rystad Energy underscores that the country’s stated renewables target may only be met by 2035, when capacity is expected to exceed 11 GW, accounting for around 20 percent of power generation.

While Kuwait is scaling up solar and wind projects, including new phases of the Shagaya initiative and a flagship 1 GW solar launch, slow policy rollout and operational delays temper expectations for the next decade.

Rystad Energy’s analysis highlights that while gas will remain the backbone for grid reliability and export economics, renewables are poised for meaningful growth by the mid-2030s, if planned investments and policy reforms succeed.